10 Medicare Supplement Plans

SHARE

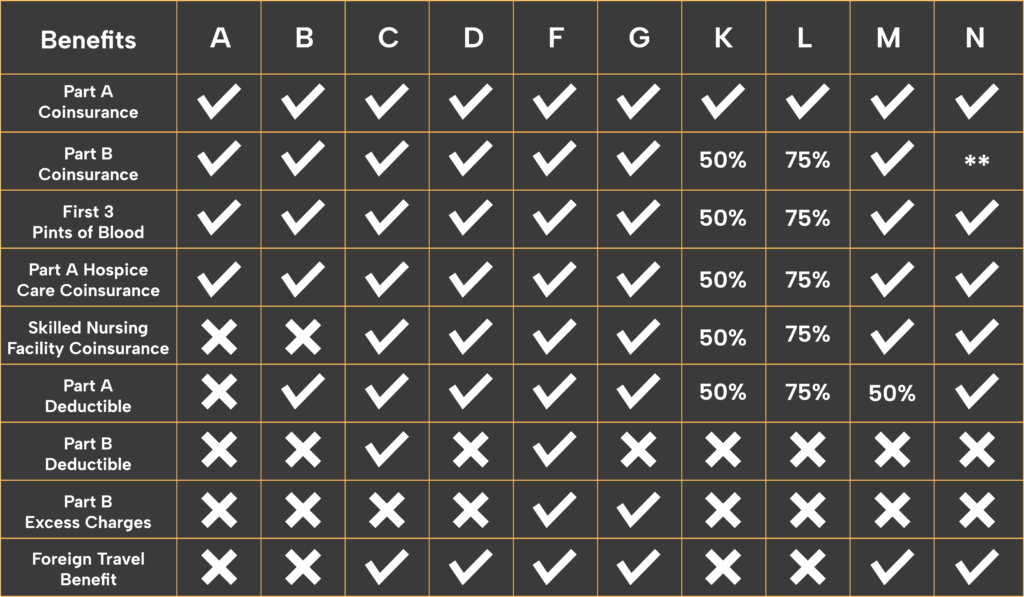

Medicare Supplement insurance plans help offset your out of pocket expenses for medical care. The plans are regulated by federal law and cover different things like copays, deductibles, and coinsurance payments.

The Medicare Supplement plans have letter names and go from A through N. However, a few policies in between are no longer available.

Private insurance companies issue Medicare Supplement plans. You secure the policy through them and pay your premiums to them, separate from any other premiums, including Medicare Part B premiums. Medicare oversees each policy, requiring standardized coverage, but the premiums may differ between companies.

At Senior Insurance Representatives, we’re here to make sure you understand your Medigap options. We’ve listed the different policies below to help you understand your coverage options.

Medicare Supplement Plans Chart

Medigap Plan A

Medigap Plan A covers the following:

- Part A coinsurance (not deductible)

- Part B coinsurance and copayment

- First 3 pints of blood in a medical procedure

- Part A hospice care coinsurance and copayments

Medigap Plan B

Medigap Plan B covers everything from Plan A plus Medicare Part A’s deductible.

Medigap Plan C

This plan is no longer available to new enrollees after January 1, 2020. If you were eligible for Medicare before January 1, 2020, you may buy Medigap Plan C, but speak with a licensed insurance agent at Senior Insurance Representatives to find out more details.

Medigap Plan D

Plan D covers:

- Part A coinsurance

- Part B coinsurance and copayment

- First 3 pints of blood in a medical procedure

- Part A hospice care coinsurance and copayments

- Skilled Nursing Facility Care Coinsurance

- Part A deductible

- 80% of foreign travel emergencies

Medigap Plan F

This plan is no longer available to new enrollees after January 1, 2020. If you were eligible for Medicare before January 1, 2020, you may buy Medigap Plan F, but speak with a licensed insurance agent at Senior Insurance Representatives to find out more details.

Medigap Plan G

Plan G covers:

- Part A coinsurance

- Part B coinsurance and copayment

- First 3 pints of blood in a medical procedure

- Part A hospice care coinsurance and copayments

- Skilled Nursing Facility Care Coinsurance

- Part A deductible

- Part B excess charge (the amount the doctor can charge beyond what Medicare allows)

- 80% of foreign travel emergencies

Medigap Plan K

Plan K covers:

- Part A coinsurance

- Part B coinsurance and copayment (up to 50%)

- First 3 pints of blood in a medical procedure (up to 50%)

- Part A hospice care coinsurance and copayments (up to 50%)

- Skilled Nursing Facility Care Coinsurance (up to 50%)

- Part A deductible (up to 50%)

- Out of pocket maximum of $5,880

Medigap Plan L

Plan L covers:

- Part A coinsurance

- Part B coinsurance and copayment (up to 75%)

- First 3 pints of blood in a medical procedure (up to 75%)

- Part A hospice care coinsurance and copayments (up to 75%)

- Skilled Nursing Facility Care Coinsurance (up to 75%)

- Part A deductible (up to 75%)

- Out of pocket maximum of $2,940

Medigap Plan M

Plan M covers:

- Part A coinsurance

- Part B coinsurance and copayment

- First 3 pints of blood in a medical procedure

- Part A hospice care coinsurance and copayments

- Skilled Nursing Facility Care Coinsurance

- Part A deductible (up to 50%)

- 80% of foreign travel emergencies

Medigap Plan N

Plan N covers:

- Part A coinsurance

- Part B coinsurance and copayment (you may owe office and emergency room copays)

- First 3 pints of blood in a medical procedure

- Part A hospice care coinsurance and copayments

- Skilled Nursing Facility Care Coinsurance

- Part A deductible

- 80% of foreign travel emergencies

How do you choose? Call us.

At Senior Insurance Representatives, we understand how hard it can be to determine which Medicare Supplement plan is right for you. Call us today and we’ll help you choose the plan that suits your wallet while providing you with the best coverage for your health needs.

Get in Touch

Click the ‘Book a Call’ button below to explore your policy options with a licensed agent.